Risk Scoring

This set of solutions is aimed at supporting insurance companies in expanding their customer portfolio and identifying the most suitable ones to acquire. OCTO technology does not only allow policyholders to be profiled based on risk exposure but also to incentivise risk reduction itself through the introduction of policies with premiums based on driving behavior.

Driving Habits

Thanks to this solution, insurance companies can move from a traditional approach based on static information to a dynamic model oriented to the end user, based on dynamic and aggregated data. This brings greater flexibility in the construction of fairer rates, as they are calculated on the actual use of the car.

The data processed by OCTO can be easily viewed via the web, already aggregated into useful statistics for the insured and the insurer such as the type of road (urban / extra-urban / motorway), the moment of the trip (day / night or the day of the week), the duration (how log the trip and stops were) and the speed average.

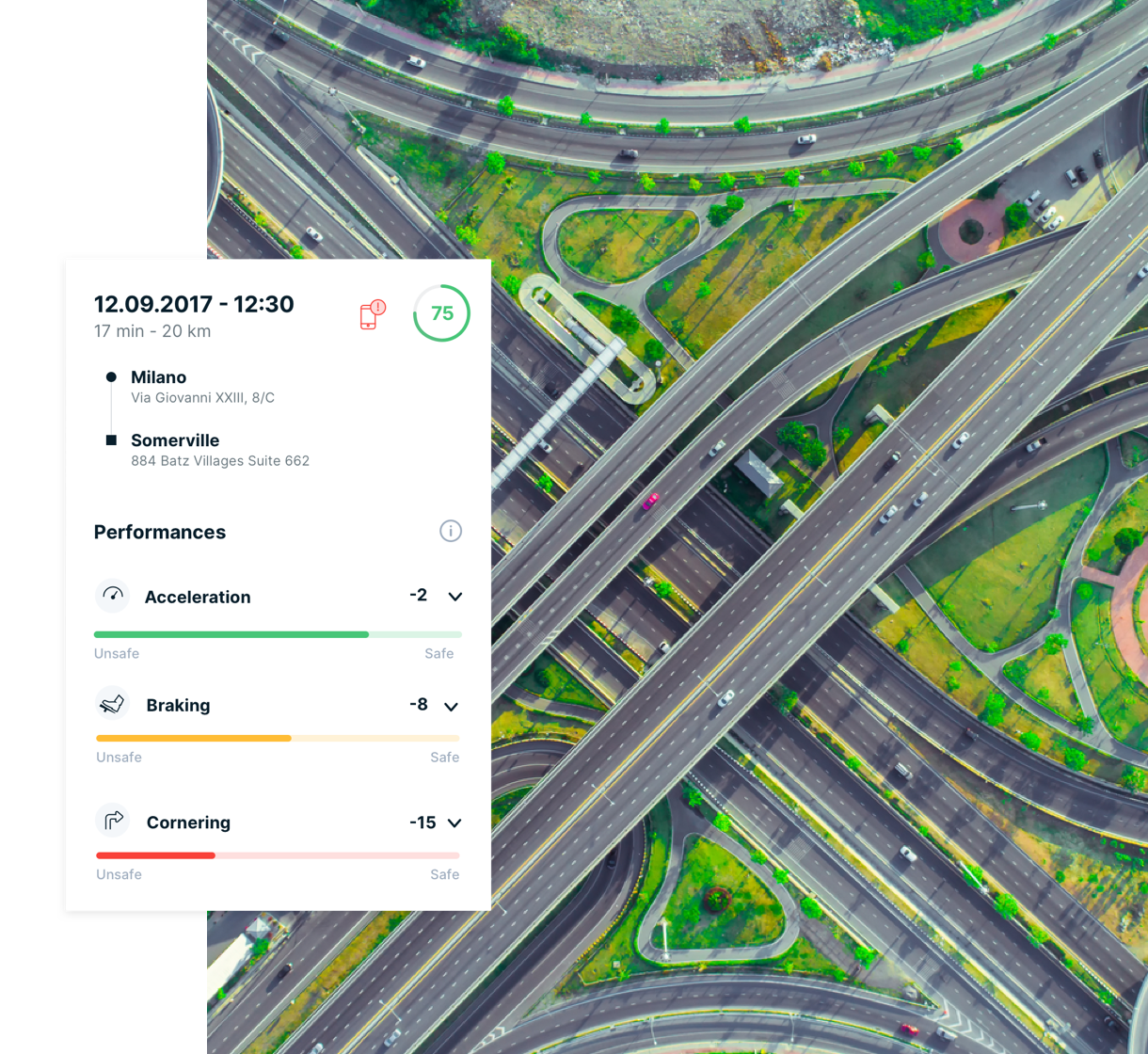

Driving Behaviour

Driving style is the basis for UBI programs development. Provides insurers with a comprehensive picture of their policyholders’ driving style and helps them improve risk predictions, use a valuable tool for developing pricing models and implement targeted actions to increase profitability (incentives, coaching programs).

Driving style is defined by events such as:

– Sudden braking and acceleration

– Curves

– Speed indicators

– Duration, direction, force of acceleration triggered

DriveAbility® Advanced Score

The flagship of OCTO risk management solutions and the result of constant evolution, DriveAbility® Advanced Score is a market-leading model born from the work of a pool of insurers who have shared their insurance claims field experience. The adoption of such solution is particularly advantageous for increasing company profitability, as it offers more opportunities for customer portfolio segmentation compared to traditional coefficients.

This score is assigned on the basis of a data collection with a high sampling rate (gps data every second).

It allows to predict the likelihood that a vehicle or a driver will be involved in an accident with a very high accuracy index (LIFT).

The company is provided with both an overall score and related details, in order to facilitate its analysis and integration with other external data. The algorithms on which it is based are flexible and adaptable to a large variety of devices.

Used by over 25 insurers on 5 continents, the adoption of The The DriveAbility® Advanced Score is particularly advantageous for increasing company profitability as it offers more opportunities for customer segmentation and accurate pricing compared to traditional factors.

DriveAbility® Standard Score

DriveAbility® Standard Score is a model that allows the construction of tailor-made programs able to meet Companies’ needs.

Having accurate risk indicators to predict the propensity to incident of policyholders is an increasingly felt need of insurance companies because it would help them to manage the pricing processes and segmentation of the customer portfolio in a more adequate way as well as support UBI programs and monitor their evolution.

The DriveAbility® Standard Score is a score that is based on predictive modeling techniques that use incident information from the OCTO database in order to measure the risk exposure of each policyholder.

The score assigned, deriving from the analysis of information on the context of habits and driving behavior, is periodically updated through the collection of new telematic data. It is displayed in the form of

• Overall score

It is related to the average driving style with reference to the overall analysis period

• Travel Score It is related to a specific and single journey.

DriveAbility® Standard Score can be used to support pricing and premium calculation processes defined by companies

DriveAbility® Engagement Score

It is the basic scoring model that insurance companies can use to involve insured parties, to promote virtuous driving and select a portfolio applying a marketing logic, by diversifying products.

Using this solution assigns a score to the insured party through a measurement model based on a linear combination of aggregated data.

The score assigned is continuously updated and defined by dynamic data on driving conduct, measured by devices on board or the smartphone app. The data aggregated in statistics is available online for both insurer and insured party.

DriveAbility® No Location Score

One way insurance companies can handle lower profitability is to obtain scores that improve the insured party’s expected risk exposure. For this a continuous predictive score is needed, even when the customer deactivates the smartphone’s GPS tracking services.

DriveAbility® No Location Score is the DriveAbility® solution that offers a continual predictive score and a high accuracy index (LIFT), even without smartphone GPS location services as it only needs a moderate data sending frequency.

Driveability® Agile Score

Driveability® Agile Score is a model that improves the experience of potential customers and company profitability, thanks to estimates based on an accurate score assigned to the user’s driving style.

Based on OCTO Driveability® Advanced Score, it calculates a predictive score after two-four weeks from when measurement was activated

Advisory & Consulting services

It is the advisory service that helps business customers integrate telematics into their business activities, such as establishing prices, managing claim requests, product marketing and sales.

OCTO digital experts have helped more than 50 companies define and launch computerised programs all over the world; constructing programs from zero and helping expert customers optimise the programs they offer.

Pay per use

Calculating the premium to be paid based on kilometres effectively travelled: that is what Pay Per Use policies are based on. The goal is to establish a personalised offer that rewards drivers who travel shorter distances favouring more prudent driving, fewer accidents and less fuel consumed.

The OCTO solution can be implemented by applying several variables, including the trip’s geographical area (area of the town or region), duration (time spent driving and time brackets) and speed (average speed measured).

Premium calculation is based on an estimate of annual kilometres to be travelled. When the policy expires, the difference based on OCTO data is calculated, and charged if kilometres travelled effectively exceeded those estimated, or credited if kilometres travelled were effectively fewer than those estimated.

Pay as You drive

Pay as You drive defines the insurance premium of customers dynamically, combining significant parameters identified by the company.

Integrating telematics with IoT connectivity enables companies to automatically and precisely collect and measure their customers’ driving data, calculating accurate insurance premiums that consider the effective risk exposure.

The parameters most used are:

– Kilometres/miles travelled

– Counting risky occurrences

– Risk related to roads travelled (based on historical data)

– Journey duration

– Speed

Request a Demo

Tell us a bit about yourself, and we’ll tell you a lot more about our solutions.