Researchers Heiko Gewald (1), Thomas Shulz (1,2), Markus Bohm (2), and Helmut Krcmar (2) published an article in Electronic Markets in November 2020, named Smart mobility- an analysis of potential customers preferences structures. The article provides an a-up to date review on this issue. Here there are some of the key issues.

Big cities and towns around the world are challenged to change the mobility behaviour of their citizens and of commuters from rural areas away from predominantly private car use and toward using alternative mobility services such as public transport or bike- and car-sharing. Such a new mobility behavior paradigm would help cities address important challenges, including traffic congestion and insufficient parking, as well as air and noise pollution. Given that the percentage of the worldwide population living in urban areas is expected to increase from 50% in 2015 to 66% by 2050 (United Nations Department of Economic and Social Affairs 2015), these challenges are pressing.

One opportunity to support behavioral changes is enabled through ongoing technical progress and the proliferation of information technology (IT). The use of smartphone apps makes alternative mobility services such as car-sharing bike sharing), or ride-sharing easier and more comfortable to use. However, alternative mobility services continue to have some weaknesses which limit their contribution to the realization of a new mobility behavior paradigm.

Smart mobility app users are provided with individualized, context-aware, and dynamic recommendations for bundling mobility services for a trip from origin to the final destination. In doing so, individual customer needs and priorities, such as information about the fastest, cheapest, or most environmentally friendly bundle of mobility services are taken into account. To be effective, smart mobility apps must account for unforeseen events like short-term cancellations or delays automatically and in real-time, adapting recommended bundles dynamically. Such features would save customers time and energy by eliminating the need to search and compare myriad mobility service offerings, combine options and adapt their trip in response to unexpected changes. Ideally, customers should be able to book and pay for bundles or at least individual tickets using their smartphones.

The study stress that unfortunately, in reality, smart mobility apps do not provide this level of functionality. A number of studies show that only a few mobility providers cooperate with the providers of smart mobility apps. This has many negative effects. For example, if providers of smart mobility apps cannot access mobility provider data, their apps can only recommend a small share of all possible bundles of mobility services. In addition, the lack of provision of real-time position data limits dynamic adaptation. Furthermore, mobility providers often do not allow providers of smart mobility apps to charge customers for tickets on a ‘one-click’ basis. To date, it is unclear how the shortcomings of smart mobility apps affect their value to customers. Only a few studies have analyzed the preference structure of potential customers.

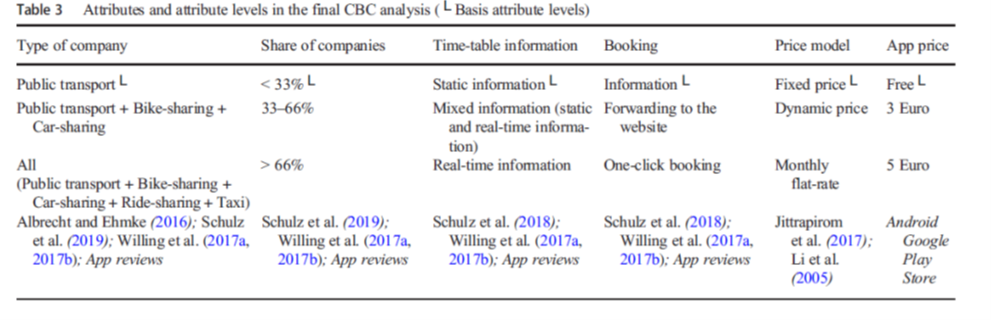

The authors highlight that the CBC analysis is a suitable and established methodology for analyzing the preferences of potential customer groups for smart mobility apps. The research focuses on analyzing potential customers’ preferences for smart mobility apps. Data collection started in July and lasted until December 2018. The data collection focused only on Germany.

Data analysis

Regardless of the participant selection, the app price was included as an attribute, as it plays a unique role in the CBC analysis. Many of the mobility apps in focus are free of charge since they are offered by mobility providers, such as public transport companies, to make their transport service more attractive. In contrast, several smart mobility apps, such as ‘Ally’ and ‘fromAtoB’, are offered by companies which do not themselves provide a transport service. For this reason, they must generate revenue via the smart mobility app (e.g., offering a fee-based app, selling advertising, charging a commission from mobility providers).

Understanding customer preference structures can help make smart mobility apps more attractive for potential customers and, hence, contribute to the reduction of private car use.

Emerging trends in the mobility sector show that “customers [are] increasingly mov[ing] away from a goods dominant perspective (e.g. buying a car)” and considering instead “the value (e.g., the flexibility and ease-of-use) offered by [, e.g.,] car-sharing applications that provide a similar mode of transportation”

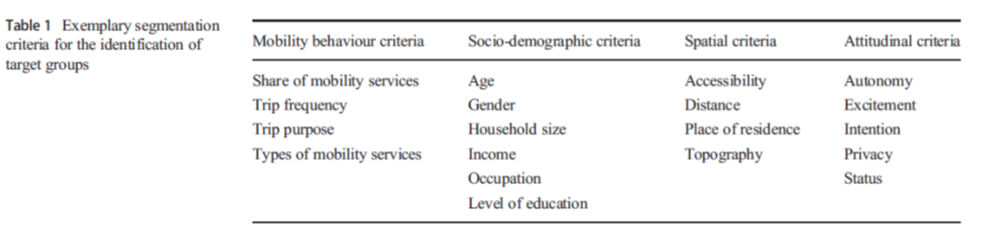

Segmenting the market into different “groups of [potential] customers with distinctly similar needs, service requirements and behavior” can provide valuable insights into how smart mobility apps should be designed.

The mobility behavior of the population can be characterized by the types of mobility services that are used over a certain period of time. The researchers conclude that since the overall goal of this study is to provide smart mobility apps that in particular contribute to switch from private car use to the use of alternative mobility services, this is the core segmentation criterion. Previous literature highlights that the route choice, and thus the linked choice of mobility services, depends individually on a high number of factors, including cost, travel time, and transfer characteristics. In the case of public transport, most of the routes require transfers “which are negatively perceived because they involve waiting time, walking, uncertainty, and loss of control over the trip”.

Similar barriers can be expected in terms of necessary transfers between all possible mobility services. Studies shows that the choice of public transport routes that include transfers can be promoted if, for example, the waiting time, reliability of connection, or information is improved. On the other hand, individual mobility behavior depends on routine and experience with mobility services, such as public transport. In turn, it is to be expected that the target groups created by mobility behavior will have different preference structures for a smart mobility app.

Discussion

Not surprisingly, young people, in particular those who live in urban areas, are early adopters of shared mobility services. (Urban) millennials also more frequently adopt apps, for example, to obtain information about the mobility services to use for a trip, or for real-time navigation. In addition, this age group considers private car ownership less important than other age groups, and they are less emotionally attached to cars. The importance of private car ownership and the emotional attachment to the car in particular among 18–24-year-olds is declining.

In contrast, especially older generations have problems accepting new IT, such as a smart mobility app.

For participants under 25 years old who use at least two mobility services per month, the ‘app price’ has a very high relative importance (41.70%) in comparison with participants who are at least 25 years old (19.76%). Interestingly, this result is not reflected in the relative importance for the attribute ‘price model’ (2.36% compared to 11.24%). When looking at the further results for those two groups, it is particularly noticeable that the younger participants have significantly lower estimated part-worths for the attribute levels ‘real-time information and ‘one-click booking’. One possible explanation is that digital natives tend to find it easy to use various apps simultaneously to find an alternative mobility service in case of a delay or in order to purchase tickets from individual mobility providers.

Earlier studies suggest that the place of residence has an effect on the preference structures of potential customers. The results of our CBC analysis reveal, in particular, that participants using at least two mobility services and who live in a town. attribute the greatest relative importance to the attribute ‘type of company’ (16.50%).

With regard to ‘mixed information’ and ‘real-time information of the attribute ‘time-table information’ no significant differences could be identified between participants who use at least two mobility services and live in big cities or towns. However, the group of participants who currently predominantly use a private car and live in a rural area attributed significantly higher estimated part-worths to these attribute levels. This could be explained by the fact that these participants have to wait a long time due to low timetable density and lack of alternative mobility services if, for example, they miss their bus due to a train delay.

The study point out that while CBC analysis is the best method to mimic the real choice decision of potential customers, it does not allow conclusions to be drawn about the use of the smart mobility app after the purchase. Future research should therefore examine continued use patterns across different groups of buyers.

While the focus of the present study is on determining the preference structure for different groups of potential customers, future work may use CBC analysis to determine their willingness to pay for smart mobility apps.

Conclusion

The researchers underline that their results indicate, among other things, that the app price is often the most important attribute affecting whether individuals choose one smart mobility app over another. In the group of participants who predominantly use a private car, however, the app price does not play a significant role, regardless of age and place of residence. Future studies should examine whether dynamic pricing can be used to increase the use of mobility services and the revenues they generate.

- Center for Research on Service Sciences (CROSS), Neu-Ulm, Germany,

- Chair for information Systems, Technical University of Munich, Germany